5 Best Free Budget App

In the realm of personal finance, the free budget app reigns supreme as an indispensable tool for taking control of your money. From tracking expenses to setting financial goals, these apps empower you to manage your finances effortlessly and effectively.

Dive into the world of free budget apps and discover the key features, user experience, security measures, integration capabilities, and reporting tools that will revolutionize your financial journey.

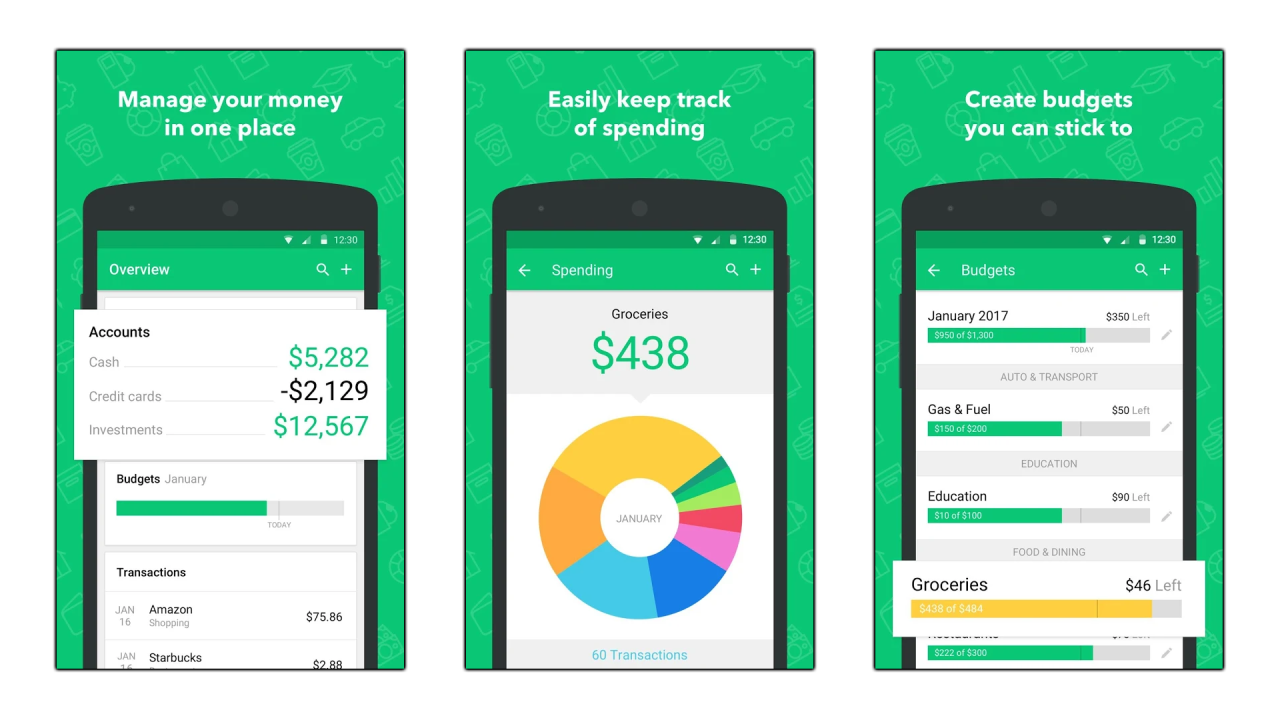

With a free budget app at your fingertips, you gain access to a wealth of features designed to simplify your financial life. Track your expenses effortlessly, create customized budgets that align with your goals, and monitor your progress towards financial freedom.

The user interface is designed with simplicity and ease of use in mind, making it accessible to everyone, regardless of their financial literacy.

App Features and Functionality

A robust budget app can be an invaluable tool for taking control of your finances. These apps offer a range of features to help you track your spending, create and stick to budgets, and achieve your financial goals.

Tracking Expenses

Expense tracking is a fundamental feature of any budget app. These apps allow you to record every purchase you make, categorizing them for easy analysis. By tracking your expenses, you can identify areas where you may be overspending and make adjustments to your budget accordingly.

Budgeting, Free budget app

Budgeting is the cornerstone of financial planning. Budget apps provide tools to help you create and manage budgets based on your income and expenses. You can set spending limits for different categories, track your progress towards your goals, and receive alerts when you exceed your limits.

Financial Goals

Many budget apps also offer features to help you set and track financial goals. Whether you're saving for a down payment on a house, a new car, or retirement, these apps can provide motivation and accountability as you work towards your objectives.

Types of Budget Apps

There are various types of budget apps available, each with its unique set of features. Some popular options include:

- Expense trackers:Focus on tracking expenses and providing insights into spending patterns.

- Budgeting apps:Offer comprehensive budgeting features, including goal setting and spending limits.

- All-in-one financial apps:Combine budgeting, expense tracking, and investment tracking into a single platform.

User Experience and Interface: Free Budget App

A free budget app's user interface plays a vital role in its effectiveness. A well-designed interface should be intuitive, easy to navigate, and aesthetically pleasing.

The best budget apps feature a clean and uncluttered design that makes it easy to find the information you need. The navigation should be simple and straightforward, with clear labels and icons. The app should also be responsive and load quickly, even on older devices.

Ease of Use

The ease of use of a budget app is paramount. The app should be simple to set up and use, even for those who are not familiar with budgeting. The interface should be clear and concise, with minimal jargon or technical terms.

The app should also provide clear instructions and tutorials on how to use its features. This will help users get started quickly and easily.

Navigation

The navigation of a budget app should be intuitive and easy to use. The app should have a clear hierarchy of menus and screens, and it should be easy to find the information you need.

The app should also use consistent design elements throughout, so that users can easily find their way around. For example, the same colors and icons should be used for similar functions.

Overall Design

The overall design of a budget app should be professional and polished. The app should use high-quality graphics and fonts, and it should be visually appealing.

The app should also be consistent with the brand of the company that created it. This will help users to trust the app and to feel confident using it.

Tips for Choosing a Budget App with a User-Friendly Interface

- Look for an app with a clean and uncluttered design.

- Choose an app with simple and straightforward navigation.

- Make sure the app is responsive and loads quickly.

- Read reviews from other users to see what they think of the app's user interface.

Security and Privacy

When choosing a budget app, it's crucial to prioritize security and privacy. Your financial data is sensitive, and you need to ensure it's protected from unauthorized access.

Free budget apps typically implement various security measures to safeguard user data. These include:

Encryption

- Encryption scrambles your data, making it unreadable to unauthorized parties.

- Look for apps that use industry-standard encryption protocols like AES-256.

Two-Factor Authentication

- Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, when logging in.

- Consider apps that offer two-factor authentication for enhanced protection.

Privacy Policies

- Review the app's privacy policy to understand how your data is collected, used, and shared.

- Choose apps with clear and transparent privacy policies that respect your data rights.

Choosing a Secure Budget App

When selecting a free budget app, prioritize the following security features:

- Encryption using industry-standard protocols

- Two-factor authentication

- Transparent privacy policies

- Positive user reviews and industry recognition

Integration with Other Tools

Integrating a free budget app with other financial tools can significantly enhance your budgeting capabilities and streamline your financial management. By connecting your budget app to other accounts and services, you gain a comprehensive view of your financial situation and automate various tasks.

Some popular integrations include:

Bank Accounts

- Sync your bank accounts to automatically import transactions and categorize expenses.

- Easily track your account balances and identify areas for improvement.

- Set up automatic transfers and payments to stay on top of bills and savings goals.

Investment Accounts

- Monitor your investment performance and track your progress towards financial goals.

- Receive alerts for important market events and adjust your investments accordingly.

- Easily rebalance your portfolio to maintain your desired risk tolerance.

Credit Cards

- Track your credit card spending and identify areas where you can cut back.

- Receive notifications for upcoming payments and avoid late fees.

- Manage multiple credit cards from a single platform and optimize your credit utilization.

Other Budgeting Apps

- Combine the features of multiple budgeting apps to create a customized financial management system.

- Share data between apps to avoid manual entry and ensure accuracy.

- Automate tasks across multiple apps to save time and improve efficiency.

Reporting and Analytics

A comprehensive free budget app should offer robust reporting and analytics capabilities to help users understand their financial habits, identify areas for improvement, and make informed decisions about their spending.By tracking expenses and income over time, the app can generate detailed reports that provide a clear picture of financial progress.

These reports can be customized to show specific categories of spending, such as groceries, entertainment, or transportation, allowing users to see exactly where their money is going.

Spending Patterns

The app can analyze spending patterns to identify areas where users may be overspending or undersaving. This information can be presented in easy-to-understand graphs and charts, making it simple to visualize spending habits and identify opportunities for optimization.

Budgeting Optimization

The app can use reporting and analytics to help users optimize their budgeting strategies. By analyzing spending data, the app can suggest adjustments to budget categories or provide personalized recommendations based on the user's financial goals.

Informed Decisions

With access to comprehensive reporting and analytics, users can make informed decisions about their finances. They can use the data to set realistic financial goals, adjust their spending habits, and plan for future expenses with confidence.

Last Point

As you embark on your budgeting journey, remember that the free budget app is your trusted companion. Embrace its features, utilize its reporting tools, and integrate it with other financial tools to create a holistic financial management system. By harnessing the power of a free budget app, you empower yourself to make informed financial decisions, achieve your goals, and live a life of financial freedom.